A hydrogen energy future in Ukraine?

Content created by

Paid and posted by

Ukraine’s gas market is changing fast. This transformation will impact the price and services offered to ordinary consumers, the development of domestic production and the country’s future energy landscape.

A joint project by the Kyiv Post and the Federation of Employers of the Oil and Gas Industry addresses these and other issues with the help of some of the best experts in the field – to determine what the future of Ukrainian energy will look like.

A joint project by the Kyiv Post and the Federation of Employers of the Oil and Gas Industry addresses these and other issues with the help of some of the best experts in the field – to determine what the future of Ukrainian energy will look like.

Around the world the climate crisis is becoming a leading concern for citizens and a priority for policy-makers. Regular images of fires in Australia or Brazil, and melting ice sheets at the poles, is leading to ever more stringent legislation and commitments from governments to drastically reduce their carbon footprints.

But few had an idea of how exactly to do that – until recently. A growing number of politicians and experts is lauding hydrogen as a potential way to reduce emissions, by replacing or complementing fossil fuel-based infrastructure, be it in heating, industrial use, or to power electric vehicles.

Ukraine’s reliance on natural gas has been a burden for the country in recent decades, making hydrogen an interesting option to both help the environment and diversify away some risk. But the investments required are likely to be substantial, and political will is needed to support what is still a weak business case to move away from natural gas.

Around the world the climate crisis is becoming a leading concern for citizens and a priority for policy-makers.

Hydrogen – future of energy or passing fad?

Hydrogen is not a new idea for energy experts. As Mykola Kadenskyi, network head at the GTS Operator of Ukraine, noted during the recent Energy Thursday webinar, hydrogen is nothing new for countries like Ukraine.

“Ukrainian nuclear scientists have long been familiar with hydrogen technology because it is used to cool generators,” Kadenskyi explained. “Of course, the volumes are small but the technological process itself is clear.”

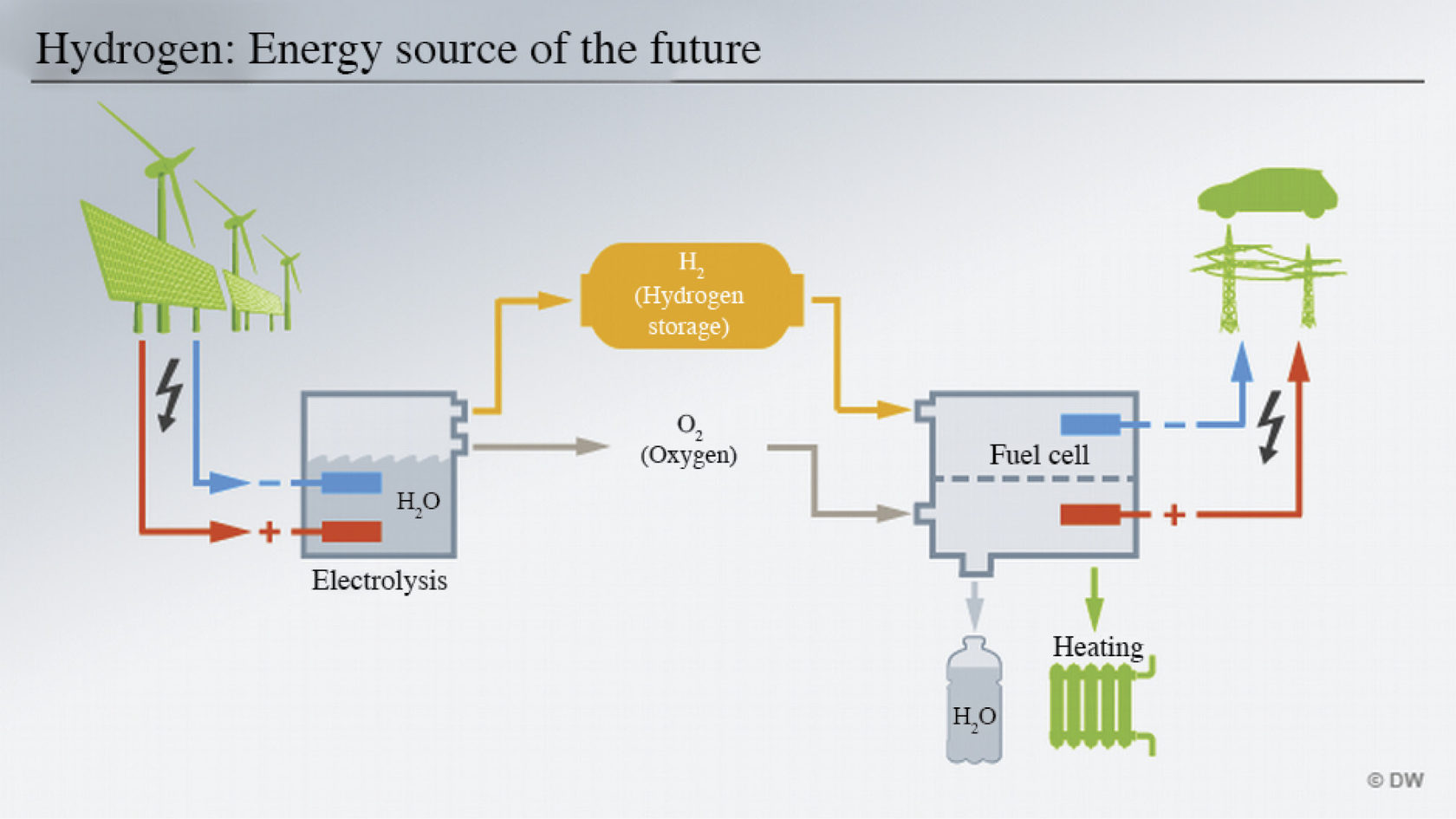

What has changed is growing concern about the looming climate crisis. “Green” hydrogen is produced through electrolysis of water, with oxygen as the only by-product (by contrast, so-called “blue” hydrogen involves splitting natural gas into hydrogen and carbon dioxide, which is the stored). As a result, it has piqued the interest of political actors prioritizing environmental goals.

...hydrogen is seen as a potential alternative for the fossil fuel dependent transport industry

According to global consultancy McKinsey, this fuel has several uses. Firstly, it serves as a catalyst for a renewables-based energy system transition, making it easier to store energy, transport it across regions, and creating a buffer in the system (shortages can be covered by using up hydrogen stocks).

Furthermore, hydrogen is seen as a potential alternative for the fossil fuel dependent transport industry (i.e., to power vehicles), for industrial uses (both for heating and as a feedstock for chemical reactions), and as an input for heating networks (diluting the natural gas currently used).

But hydrogen also has its sceptics. Most importantly, experts are concerned about other technologies supplanting hydrogen as a preferred energy source – notably batteries that are becoming increasingly effective at storing electrical energy.

Energy transformations require huge investments, with plans being made in five-year installments or even decades. Imagine the fallout if a country bets on batteries, builds thousands of charging and storage stations, consumers buy millions of vehicles, and then the world moves to hydrogen.

But batteries and hydrogen are not necessarily at odds, argues McKinsey. “The relative strengths and weaknesses of these technologies, however, suggest that they should play complementary roles,” reads a recent report, which suggests that lighter batteries are more efficient on smaller distances (personal vehicles), while hydrogen delivers better at long ranges (industrial vehicles or transport). Moreover, batteries would not supplant the role of hydrogen in industry or heating.

Energy transformations require huge investments, with plans being made in five-year installments or even decades

The hydrogen business case

Germany and the Netherlands have been frontrunners in using hydrogen and are currently the European Union’s two biggest producers. The issue is particularly critical for the Netherlands, which is shutting down its giant Groningen gas field (Europe’s largest) and aims to become a hydrogen hub.

But a growing number of European countries are jumping on the hydrogen bandwagon. The United Kingdom made headlines earlier this year when it injected up to 20% of hydrogen into the natural gas network of Keele University (in Staffordshire), feeding 100 homes and 30 faculty buildings. This trial showed the feasibility of the solution, and prompted the country’s five gas networks to develop and lobby for a plan that includes £264 million in gas network investments with the goal of integrating more hydrogen.

But increased usage does not necessarily mean there is a strong business case warns Vadym Glamazdin, Development Director for the Federation of Employers of the Oil and Gas Industry.

“I understand the political case – more ecological, less reliance on fossil fuel – but I don’t see the business case,” he warned during recent Energy Thursday discussions, adding that we need to be careful not to fall into a trap where we spend energy, in succession, to build hydrogen stocks, transfer them into the network, and then convert them into heat and energy once again.

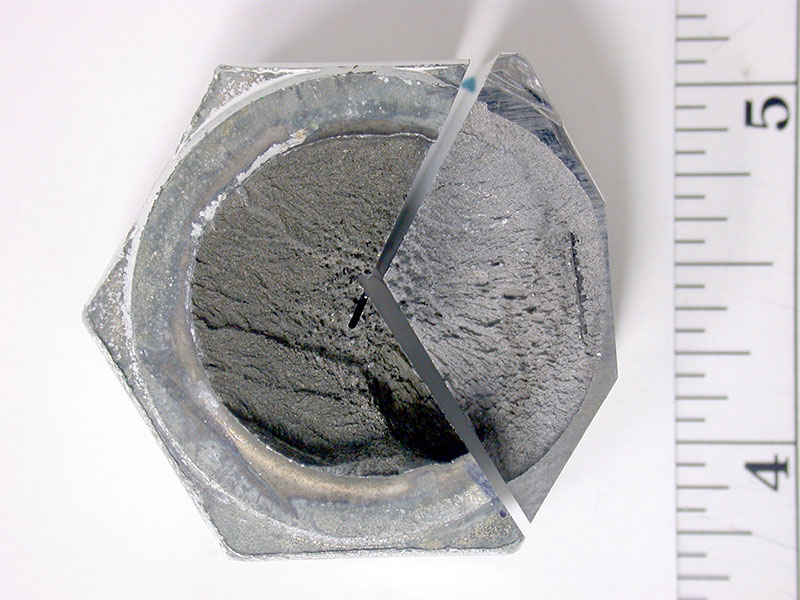

"The idea of hydrogen as a large, strategic battery is fantastic. The ecological advantage is clear,” Glamazdin expounded. “But we should keep in mind the disadvantages. Hydrogen literally seeps through the metal and destroys it. It is very difficult to store and transport."

According to former Deputy Energy and Environmental Protection Minister Oleksiy Ryabchyn, however, the business case for hydrogen exists and it is based on the ever-declining costs of the new technologies. “We have seen this with solar, we see it with other renewables, and this will also happen to hydrogen”.

Increasing hydrogen production and investing in innovation could cause costs “to decrease by up to 50% by 2030...

A recent study by the Hydrogen Council – an industry association driven by leading players – estimates that increasing hydrogen production and investing in innovation could cause costs “to decrease by up to 50% by 2030 for a wide range of applications, making hydrogen competitive with other low-carbon alternatives and, in some cases, even conventional options”.

The idea of hydrogen as a large, strategic

battery is fantastic.

The ecological advantage is clear.

battery is fantastic.

The ecological advantage is clear.

The amount of investment required to deliver this improvement, however, can seem daunting – the report estimates that $70 billion of investment will be needed to make hydrogen competitive. Although this seems like a lot, it is worth noting that last year alone Germany invested about $30 billion in renewables.

Vadym Glamazdin

The Ukrainian hydrogen opportunity?

The most immediate use of hydrogen in Ukraine is in heating. Specifically, blending hydrogen and natural gas and using the mix in the country’s gas transport network. Such a blend would thus both reduce Ukraine’s dependence on imported gas (in turn, reducing the security and political risks linked to reliance on an external import), and the overall carbon footprint.

Stańczak believes that Ukraine is particularly well-suited for such experiments, as the network is large and “very branched”. He added: “We are ready to allocate some local segments for experiments on the transportation of a mixture of natural gas and hydrogen.”

If successful, the opportunity could be significant. The McKinsey report estimates that in countries with developed gas networks (like Ukraine), could see hydrogen take up as much as 15-20% of the heating market share – if they make the necessary investments.

"We already have surplus electricity, we have a developed system of renewable energy sources, such as solar and wind energy. This also carries for electricity produced by our nuclear power plants, which we currently do not fully use,” Zerkal said.

We are ready to allocate some local segments for experiments on the transportation of a mixture of natural gas and hydrogen.

Ukraine should first test the solution in specific localized sections, argues Pawel Stańczak, Deputy General Director of Development and Transformation GTSOU. "Pure hydrogen really destroys pipelines. Therefore, it is transported in a mixture with other gases - natural gas or synthetic methane. But you need to prepare for this,” he warned.

Pawel Stańczak

Before jumping in with both feet, however, it is important to first test the waters. Hydrogen embrittlement – a process in which the fuel damages metal and can lead to cracks – remains poorly understood and can depend on a number of factors. As a result, it is unclear how this would play out in a given gas network.

Ukraine has strong prospects to develop hydrogen energy in cooperation with the European Union, argues Lana Zerkal, Advisor to the Naftogaz CEO. The bloc's “Green Agreement" foresees the full decarbonization by 2050, which will require a lot of electricity. The EU is already looking for partners in its neighborhood and has recognized Ukraine as a strategic partner, she told the participants of the Energy Thursday talk.

Lana Zerkal

Ukraine has strong prospects to develop hydrogen energy in cooperation with the European Union

The Kyiv Post is following global trends and has launched a division in the commercial department responsible for creating compelling branded content, sometimes referred to as native advertising.

We aim to set the standard for great branded content, and keep the Kyiv Post strong so that it can continue to serve our community, and Ukraine, as its global voice.

We aim to set the standard for great branded content, and keep the Kyiv Post strong so that it can continue to serve our community, and Ukraine, as its global voice.

CONTACTS

31A Pushkinska Street, 1st floor, Suite 5, Kyiv, Ukraine, 01004

advertising@kyivpost.com

+38 044 591 77 88

advertising@kyivpost.com

+38 044 591 77 88

Copyright © 2020 KyivPost Brand Studio